Alarm Bells Ringing at COP28: Global Stocktake in focus

Alarm Bells Ringing at COP28: Global Stocktake in focus

As COP28 approaches, the first-ever global stocktake casts a stark light on our collective climate progress. While the Paris Agreement goals remain, the reality paints a sobering picture: we’re off track. The 1.5°C target hangs precariously, and the window for meaningful change is rapidly narrowing. This critical juncture demands immediate action.

COP28 presents a pivotal opportunity. The global stocktake serves as a mirror reflecting both our achievements and shortcomings, guiding us towards more ambitious climate action plans. Governments will make a crucial decision at COP28, one that can set the course for our collective future. This decision holds the potential to accelerate ambition, unlock resources, and propel us towards a sustainable tomorrow.

Yet, the path forward demands more than mere words. We must collectively rise to the challenge, leveraging the global stocktake as a springboard for urgent action. Join us as we delve deeper into the implications of the global stocktake, exploring the challenges that lie ahead and the opportunities we must seize. Together, let us amplify the call for action and build a world where climate ambition translates into tangible results.

What is Global Stocktake?

Imagine taking a comprehensive inventory of your home, examining each item and its purpose. This is precisely what the global stocktake does for climate action. It’s a meticulous process of assessing our collective progress, identifying areas where we’re falling short, and collaboratively charting a course for a more sustainable future.

Occurring every five years, the global stocktake will culminate at COP28, offering a critical opportunity to inform the next round of climate action plans known as NDCs. By holding up a mirror to our collective efforts and highlighting areas needing improvement, the stocktake empowers policymakers and stakeholders to strengthen their commitments and pave the way for accelerated action.

Think of it as a strategic pause to assess our journey towards the Paris Agreement goals. It’s a chance to identify gaps, learn from successes and failures, and ultimately, chart a more ambitious course forward. By embracing the insights gained from this global inventory, we can collectively translate good intentions into concrete action, propelling us towards a more sustainable and resilient future.

The Scope of the Global Stocktake

The global stocktake goes beyond a mere assessment of progress. It delves into the very core of our collective climate action, scrutinizing three key areas:

- Mitigation: This pillar focuses on evaluating how successfully we’re reducing greenhouse gas emissions. It analyzes our progress towards the ambitious targets of keeping global warming below 2°C and ideally 1.5°C, while identifying potential for even deeper emission cuts.

- Adaptation: Here, the stocktake assesses how countries are strengthening their resilience and reducing vulnerabilities to climate impacts. It examines their ability to adapt to the changing climate and minimize potential damage.

- Means of Implementation: This area scrutinizes the financial, technological, and capacity-building support provided to developing nations. It evaluates the alignment of financial flows with emissions reduction and climate-resilient development goals, ensuring that these nations receive the resources they need to tackle the climate crisis effectively.

Furthermore, the global stocktake extends its reach to address:

- Loss and Damage: This examines the actions and support needed to respond to climate impacts exceeding a community or ecosystem’s ability to adapt. It recognizes the devastating consequences of climate change and seeks solutions to address them.

- Response Measures: This acknowledges the potential unintended social and economic consequences of climate action. It seeks to minimize these impacts and ensure that climate action is implemented in a just and equitable manner.

- Science and Equity: The stocktake emphasizes the importance of relying on the best available science to inform climate strategies. It also underscores the critical need for promoting equity and ensuring that all stakeholders are involved and benefit from the transition to a sustainable future.

In essence, the global stocktake acts as a comprehensive audit of our climate action efforts, leaving no stone unturned in its quest for a more sustainable tomorrow. By rigorously examining every aspect of our progress, we can identify areas for improvement, strengthen our commitments, and pave the way for a future where climate action is the norm, not the exception.

A Stark Wake-Up Call

While the Paris Agreement has undoubtedly spurred global climate action, the sobering reality revealed by the global stocktake is that implementation falls short across all areas. The ambitious 1.5°C target remains elusive, and current emissions trends paint a bleak picture. Despite pockets of progress, adaptation efforts are insufficient to meet the growing challenges of climate change.

The stocktake emphasizes the need for a radical shift – a systems transformation. This entails a whole-society, whole-economy approach that seamlessly integrates climate resilience and development with low greenhouse gas emission strategies. Such sustained efforts over decades are crucial to achieving sustainable development and eradicating poverty, ensuring a future where both environmental and human needs are met.

However, a stark disparity exists between the needs of developing nations and the support provided. The stocktake calls for unlocking and redirecting trillions of dollars towards climate action and climate-resilient development in these countries. Only by closing this financial gap can we ensure a just and equitable transition to a sustainable future for all.

The global stocktake is not merely an assessment; it’s a clarion call for action. It serves as a roadmap for closing the implementation gap, reminding us of the urgency and the magnitude of the task ahead. By embracing the insights it offers, we can collectively chart a more ambitious course, transforming our climate action efforts into tangible results that safeguard the planet for generations to come.

Findings hint towards a Call for Urgent Action

The initial findings of the Global Stocktake paint a clear picture: we are not doing enough. Despite some progress, the current trajectory of climate action falls short on all fronts, jeopardizing the long-term goals of the Paris Agreement.

Key findings across the three main goals are alarming:

Mitigation:

- Emissions Gap: Current national plans leave a massive gap of 20-24 billion tons of CO2 equivalent between projected emissions and what’s needed for a 1.5°C pathway.

- Ambition Needed: Updated NDCs must be significantly more ambitious, including phasing out fossil fuels and halting deforestation.

- Cost-Effective Solutions: Green industrialization and other strategies offer opportunities to cut emissions while promoting development.

- Just Transition: Shifting away from fossil fuels requires careful planning to minimize disruptions to jobs and communities.

Adaptation:

- Closing Window: The window to adapt to climate impacts is rapidly closing, demanding urgent action.

- Fragmented Efforts: While ambition is increasing, adaptation actions are often disconnected, incremental, and unequally distributed.

- Local Context Matters: Adaptations must be driven by local needs and populations, including marginalized groups.

- Scaling Up Finance: Rapidly increasing finance for adaptation and addressing loss and damage is crucial.

Implementation and Finance:

- Finance Shortfalls: Despite progress, developed countries are not providing enough financial support to developing countries.

- Global Financial Transformation: The global financial system needs to be redesigned to support climate action.

- Simplified Access: Developing countries need easier access to international climate funds.

- Technology Transfer: Accelerating technology transfer is vital for implementing climate solutions.

Implications for the Future:

The Global Stocktake findings demand a strong political response from countries. This includes:

- Updated NDCs: Countries must significantly increase the ambition of their national climate action plans by 2025.

- Biennial Transparency Reports: These reports will track progress towards agreed goals.

- Ratcheting Up Mechanism: The Global Stocktake is a key element in the process of continuously strengthening climate action to meet the Paris Agreement goals.

The Global Stocktake serves as a wake-up call. It is time to move beyond incremental change and embrace a transformative approach to climate action. We must act collectively and urgently to secure a sustainable future for all.Next Steps after the Global Stocktake

UAE is making Abayas go Sustainable

UAE is making Abayas go Sustainable

In a land known for its opulence and architectural marvels, a new wave of Eco-consciousness is sweeping across the United Arab Emirates (UAE). The UAE, with its towering skyscrapers and luxurious lifestyle, is embracing a more sustainable and environmentally responsible future. This transformation is evident in the innovative initiatives that are turning plastic bottles into stylish clothing and crafting biodegradable Abayas, a traditional attire worn by many Emirati women.

A Sustainable Vision for the Future

Deeply embedded in the UAE’s long-term vision is a strong commitment to being eco-friendly, especially when it comes to managing waste. The goal is pretty ambitious: cut down on carbon emissions, protect nature, and encourage practices that use sustainable energy. And guess what? The fashion industry is taking the lead in making this happen, making it a crucial part of the UAE’s promise to take care of the climate.

Now, when we talk about sustainable fashion in the UAE, here’s something really cool – they’re turning used plastic bottles into clothes. It isn’t just about helping the environment; it’s also a bold fashion move. Big brands are jumping on board, making the UAE a trendsetter in turning piles of plastic waste into stylish clothing.

But that’s not all. The UAE’s sustainable fashion scene also loves materials that can easily go back to nature, like bamboo, organic cotton, and Tencel. These are the good-for-the-environment fabrics used to make traditional Abayas. So, not only are these clothes comfy and breathable, but they’re also a way of saying, “Hey, we care about the planet.”. In the UAE, they’re not just making clothes; they’re telling a story of style that goes hand in hand with taking care of our world.

Sustainable Local Excellence

DGrade: This Dubai-based company specializes in transforming millions of discarded plastic bottles into high-quality yarn. The process involves collecting, sorting, washing, and shredding plastic bottles into small flakes. These flakes are then melted and spun into threads, which are woven into soft, breathable, and sturdy fabrics. DGrade’s recycled polyester is used to create a range of clothing, including Abayas, T-shirts, jackets, and hats.

Al Amira Fashion: Another Dubai-based brand, Al Amira Fashion, specializes in sustainable Abayas crafted from bamboo, organic cotton, and Tencel. These Abayas offer breathability, moisture-wicking properties, and a silky touch. They are wrinkle-resistant and easy to maintain. The organic cotton used in their production is farmed without the use of pesticides or herbicides, while Tencel Abayas are created from sustainable wood pulp.

Fashion made from recycled plastic bottles and biodegradable materials brings several environmental benefits. First and foremost, it significantly reduces plastic waste, thereby conserving natural resources. Additionally, it plays a role in reducing greenhouse gas emissions. DGrade, for instance, has contributed to recycling an impressive 60 million plastic bottles since its inception, leading to a substantial reduction in global plastic waste.

Sustainable Abayas from Al Amira Fashion also contribute to environmental preservation. Bamboo Abayas save water and reduce the need for pesticides. Organic cotton Abayas help conserve water and eliminate the use of pesticides, while Tencel Abayas play a role in minimizing deforestation.

COP28: A Global Stage for Environmental Action

In November 2023, Dubai, UAE, will host the 28th Conference of the Parties (COP28) to the United Nations Framework Convention on Climate Change (UNFCCC). COP28 is a crucial global event where world leaders converge to address climate change and formulate strategies to reduce greenhouse gas emissions.

Sustainable fashion stands as a prime example of the UAE’s environmental efforts, aligning with the Dubai Fashion & Design Council’s Sustainability Program and other government initiatives. These efforts not only support sustainability in fashion but also contribute to a larger global movement towards a greener and more responsible fashion industry.

Inspiring an Eco-Conscious future with Style

The journey towards sustainable fashion in the UAE has only just begun. The future holds promise, with potential collaborations with international brands, ongoing research into eco-friendly materials, and educational efforts aimed at raising awareness about responsible fashion practices. With the world’s eyes on the UAE, this nation is poised to inspire a global shift towards Eco-conscious and sustainable fashion.

In a region renowned for luxury and extravagance, the UAE is boldly embracing a more sustainable path, symbolized by the transformation of discarded plastic bottles into garments and the creation of biodegradable Abayas. As the world gears up for COP28, the UAE positions itself as a champion of sustainable living and climate responsibility.

Moglix, an Asia-based B2B commerce startup, is playing a pivotal role in the UAE’s sustainable economic landscape. The company is aligned with the UAE’s vision for a greener future by assisting SMEs and major organizations in digitizing their procurement processes. Learn more about how Moglix is at the forefront of promoting sustainability in procurement, aligning perfectly with the UAE’s journey towards a more sustainable future.

The Solar Renaissance in the UAE: Illuminating Tomorrow

The Solar Renaissance in the UAE: Illuminating Tomorrow

In the arid expanse of the Arabian desert, where temperatures soar and sunlight prevails, the UAE, synonymous with towering skyscrapers and a flourishing oil economy, is pioneering a transformative solar revolution to embrace a greener future. Let’s delve into the radiant world of the UAE, embracing solar energy as a beacon for sustainable progress.

The Current Solar Endeavors in the UAE

The UAE’s expanding solar portfolio underscores its steadfast commitment to solar power. Notably, Dubai’s Mohammed bin Rashid Al Maktoum Solar Park, positioned as the world’s largest single-site solar park, is set to generate 5,000 megawatts by 2030 across 40 sq. km.

Smaller yet significant projects, including the 1,177-megawatt Noor Abu Dhabi Solar Plant, mirror the nation’s dedication to energy diversification and reducing reliance on fossil fuels. As of September 2021, solar power constitutes 9% of the UAE’s total energy consumption, a figure expected to ascend with the nation’s unwavering commitment to solar energy.

Motivation Behind the UAE’s Solar Transition

The UAE’s pursuit of solar energy extends beyond economic diversification. Driven by environmental consciousness, the nation aims to mitigate the ecological repercussions of fossil fuel dependency. By embracing solar electricity, the UAE not only secures its energy future but also positions itself as a global environmental advocate actively combating climate change.

The UAE’s solar initiative yields unique advantages beyond clean energy generation. It stabilizes the energy supply, mitigating the country’s vulnerability to oil price fluctuations. Moreover, the shift towards green energy fosters economic growth and technological innovation, establishing the UAE as a pioneering force in renewable energy. This, in turn, attracts investments and enhances the nation’s global image.

Government-Led Initiatives Fueling the Solar Momentum

The UAE government spearheads the solar revolution, offering incentives like feed-in tariffs and power purchase agreements to entice private-sector participation in renewable energy projects. Noteworthy is the UAE Council for Climate Change and Environment, showcasing the nation’s commitment to sustainability.

The UAE’s solar future shines brightly, with explorations into concentrated solar power and energy storage technologies to enhance efficiency and reliability. Collaborations with international partners and experts will likely play a pivotal role in realizing these sustainable development goals.

The robust environmental connection between India and the UAE sees Indian enterprises actively engaging in solar projects. This collaboration, driven by shared concerns about energy needs, serves as a model for sustainable development.

COP28: A Pinnacle in the UAE’s Climate Endeavors

As the UAE strides towards Net Zero emissions, its hosting of COP28 in Dubai from November 30 to December 12, 2023, aligns seamlessly with its solar power commitment. The global platform will showcase the UAE’s achievements in SDGs and advocate for collective action on climate change.

The UAE’s solar revolution marks a monumental stride towards a sustainable and eco-friendly future. Beyond the realm of solar technology, industries such as B2B trade are embracing solar power to foster growth. Pioneering this transition is Moglix, a key player in providing supply chain and digital procurement solutions. Explore the transformative impact of technology on efficiency, cost reduction, and global industry growth with Moglix.

Dubai’s Pioneering Journey Towards 100% Water Utilization

Dubai’s Pioneering Journey Towards 100% Water Utilization

Dubai, the vibrant metropolis of the UAE, is renowned for its opulence and innovation. In recent years, the city has embarked on a remarkable journey toward achieving 100% water consumption, aligning with its role as the host of COP28, its commitment to sustainable practices, SDG goals, and global leadership.

The Uniqueness of Dubai’s Water Challenge

Dubai’s water management challenges are as unique as the city itself. Nestled in a desert climate characterized by scorching heat and limited freshwater sources, Dubai has had to employ innovative water sustainability strategies. The city’s rapid urbanization and population growth have put significant stress on these water resources, making water efficiency a paramount concern. The exacerbation of these problems due to rising global temperatures, a consequence of climate change, adds to the complexity.

The Dubai Way: Recycling and Desalination

Dubai’s ambitious goal of achieving 100% water utilization hinges on two primary methods: recycling and desalination.

Wastewater Recycling: Dubai Municipality has introduced cutting-edge wastewater treatment plants that adhere to rigorous quality standards. This purified water, known as “gray water,” finds application in irrigation, cooling, and industrial processes. This strategy not only conserves precious freshwater but also reduces the environmental impact associated with wastewater discharge.

Desalination: Recognizing the pressing need for freshwater in this arid region, Dubai has made substantial investments in desalination technology. The city boasts some of the world’s largest desalination plants, which efficiently convert saltwater into freshwater. The Dubai Way optimizes desalination processes to minimize energy consumption and environmental consequences.

The Evolution of Water Reclamation

Dubai’s journey towards water reclamation began in the late 1960s, marking a pivotal turning point in the city’s sustainable growth. In 1969, the Dubai Municipality established the first wastewater treatment plant in Al Khawaneej. The rapid urbanization of Dubai necessitated an expanded wastewater treatment and reclaimed water capacity, leading to the inauguration of the Warsan plant in 1981. By 2006, Jebel Ali further expanded Dubai’s water recycling capacity to meet the burgeoning demand for reclaimed water, bolstering water conservation efforts.

The Future of Dubai’s Water Management

Dubai’s water management objectives closely align with the goals of COP28 and the UN’s Sustainable Development Goals (SDGs). As the host of COP28, Dubai seeks to serve as a global exemplar of sustainable practices. The city is determined to make its water consumption sustainable and reduce its overall water footprint. This is being achieved through:

Innovation: Dubai is actively funding research in water purification and desalination energy efficiency. The city leverages modern technology and intelligent systems for the monitoring and regulation of water usage.

Public Awareness: Dubai Municipality vigorously promotes water conservation among its residents and businesses. Awareness campaigns and incentives play a crucial role in encouraging people and enterprises to adopt water-saving practices.

Sustainable Cities: Dubai is pioneering sustainable urban development in the region. Projects like Masdar City and Sustainable City Dubai exemplify water-sustainable, energy-efficient, and environmentally friendly urban living.

Dubai’s ambitious quest for 100% water utilization sets a remarkable example of sustainability and innovation. The city has harnessed the power of recycling and desalination to secure its water future, overcoming distinctive challenges. By hosting COP28 and adhering to the principles of the SDGs, Dubai showcases its unwavering commitment to the global community. The city’s ultimate aspiration is to eradicate water scarcity and construct sustainable desert communities by embracing the Dubai Way.

Moglix in the UAE is working in this space to ensure organisations (private and public)their sustainability goals are aligned with their procurement goals. Moglix is the most comprehensive procurement solution in the UAE, that combines E catalog based buying experience, digital procurement and supply chain solution with a physical warehouse and logistics network, allowing you a complete and most comprehensive E2E procurement and supply chain solution. Reach Us

COP 28: The Middle East’s Adaptive Reuse Phenomenon is Revolutionizing Sustainability

COP 28: The Middle East’s Adaptive Reuse Phenomenon is Revolutionizing Sustainability

The grandeur of the Middle East often overshadows the pressing need for sustainable practices in the region. As the world marches towards a greener future, the Middle East is now awakening to the potential of adaptive reuse, a trend that has been transforming underused buildings and sites worldwide. This concept is redefining the landscape of the Middle East and heralds a sustainable revolution in architecture and urban planning.

Adaptive Reuse: A Global Trend

Adaptive reuse, the process of reimagining older structures, is gaining momentum globally. It involves transforming underused buildings into more practical and functional spaces, ensuring that the architectural heritage is preserved while addressing modern urban needs. Cities like New York and London have been at the forefront of this trend, redefining their landscapes and preserving history simultaneously. New York’s One Wall Street, once an office building, has now found new life as a residential haven, and London’s No.1 Grosvenor Square is now a super-prime residential complex. Battersea Power Station, a decommissioned landmark, is currently undergoing transformation into a mixed-use development. These global success stories have set the stage for adaptive reuse to become a game-changing phenomenon.

Middle East is Adapting

In the Middle East, adaptive reuse is not a new concept. The UAE government has showcased the benefits of re-purposing old structures, with projects like the Bastakiya neighborhood and Al Serkal Avenue. The Bastakiya neighborhood now boasts cafes, art galleries, and boutique hotels, preserving its historical significance while fostering culture and community. Al Serkal Avenue, once an industrial zone, has become a hub for arts and culture, contributing to a vibrant arts community.

Expo City Dubai exemplifies the potential of adaptive reuse. The site, originally developed for World Expo 2020, has been entirely reimagined into a self-sustaining, 15-minute city. It prioritizes eco-friendliness, with green roofs and smart energy-saving appliances, setting a new standard for sustainable living. This transformation not only pays homage to the area’s past but also presents a promising future for the region

The Middle East is embracing sustainability as a core value. Re-purposing existing structures instead of constructing new ones significantly reduces carbon emissions, aligning with the United Nations Environment Program’s call to address the construction sector’s high carbon footprint. With the UAE’s construction market soaring, the need for sustainable solutions is evident.

‘Year of Sustainability

The UAE declared this year the ‘Year of Sustainability,’ aligning with COP28, emphasizing the importance of sustainable living. This move is expected to encourage regional developers to prioritize sustainability in their projects. As more people choose the Middle East as their home, the demand for housing and entertainment destinations will rise. Adaptive reuse projects offer an efficient and sustainable option to meet these needs. Buyers are increasingly drawn to high-quality adaptive reuse projects, and this trend is likely to continue. It’s an exciting era for sustainable development in the region.

Moglix in the UAE is working with real estate and construction companies to ensure their sustainability goals are aligned with their procurement goals. Moglix is the most comprehensive procurement solution in the UAE, that combines E catalog based buying experience, digital procurement and supply chain solution with a physical warehouse and logistics network, allowing you a complete and most comprehensive E2E procurement and supply chain solution. Reach Us

UAE and India: Crafting a High-Tech Future Together

UAE and India: Crafting a High-Tech Future Together

In a remarkable stride towards strengthening their economic and technological bonds, the United Arab Emirates (UAE) and India have unveiled a vision to bolster sustainable industrial development. This dynamic partnership sets the stage for mutual investments, technology transfers, and the adoption of cutting-edge innovations across various industries. The memorandum of understanding (MoU) was signed during the 11th meeting of the UAE-India High-Level Joint Task Force on Investments, showcasing a remarkable leap forward in their collaborative journey.

So, what’s in the pipeline? Let’s dive into this exciting alliance, where two nations join hands in a harmonious rhythm of growth and development.

Economic Partnership for the Ages

The MoU aligns seamlessly with the UAE-India Comprehensive Economic Partnership Agreement (CEPA). This strategic pact is a game-changer, designed to elevate trade and logistics ties between these two vibrant nations. The recent signing ceremony, presided over by Dr. Sultan Al Jaber, UAE Minister of Industry and Advanced Technology, and Piyush Goyal, India’s Minister of Commerce and Industry, marked a milestone in the strengthening of bilateral relations.

The Magnificent Seven: Key Areas of Collaboration

The collaborative efforts under the MoU are set to shape the future in seven key areas. Let’s take a sneak peek into what’s on the horizon:

1. Supply Chain Synergy

The UAE and India will join hands to identify opportunities for the supply of raw materials.

They’ll be sharing best practices for industrial growth, making sure this cooperation thrives in various domains, from energy to land, and technology to labor incentives.

2. Energizing the Future

Energy storage technologies, Smart Grid deployment, and IoT applications will be the focus.

Extensive research and development (R&D) in renewable energy and energy efficiency will lead to sustainable advancements.

3. Health & Life Sciences

Collaborating in the development of pharmaceuticals and unleashing the power of biotechnology.

Expect groundbreaking R&D to create innovations that’ll redefine healthcare.

4. Beyond the Stars

A combined mission to elevate their space industries, including the development, launch, and utilization of small satellites.

They’re even exploring space exploration and licensing of space-related materials – sounds like a journey to the cosmos!

5. AI-Powered Progress

With AI at the helm, the UAE and India are set to elevate multiple sectors, from space and energy to healthcare and supply chains.Advanced machine learning and data analytics are also on the roadmap for these forward-thinking nations.

6. The Revolution of Industry 4.0

Get ready for real-time data processing, autonomous robotics, and additive manufacturing across industries.These are the building blocks of the Fourth Industrial Revolution (4IR), shaping the industries of tomorrow.

7. Standardization and Beyond

Here, the focus is on standardization, metrology, conformity assessment, accreditation, and Halal certification.Their aim? To harmonize standards with international requirements and foster mutual recognition of conformity assessment results.

A Vision of Sustainable Growth

Dr. Sultan Al Jaber emphasizes that this MoU perfectly aligns with the UAE’s national industrial strategy and the “Make it in the Emirates” initiative. This ambitious venture seeks to transform the UAE into a global hub for advanced industries, especially those destined for the future.

Piyush Goyal, India’s Minister of Commerce and Industry, highlights the potential of the MoU to unlock new dimensions in emerging technologies. From space exploration to healthcare, renewable energy, artificial intelligence, and more, this collaboration is poised to break new ground.

As per the MoU, the UAE and India will join forces in industrial and academic collaborations, collaborative research and development projects, and best practice sharing. This partnership is more than just an agreement; it’s a catalyst for economic growth, diversification, and sustainability across key industries.

In this era of limitless possibilities, the UAE and India are crafting a high-tech future together. It’s not just an alliance; it’s a glimpse into the limitless potential of shared dreams and endeavors.As these nations bridge the divide, the rest of the world watches with bated breath, eager to see the remarkable transformation they’ll bring to life. After all, the future has never looked more promising.

The India-Middle East-Europe Economic Corridor – All you should know about

The India-Middle East-Europe Economic Corridor – All you should know about

In a significant development during the recently concluded G20 summit held in New Delhi, India, a groundbreaking initiative was unveiled, with far-reaching implications for geopolitics and global connectivity. The United States, India, Saudi Arabia, the United Arab Emirates, along with France, Germany, Italy, and the European Union, jointly introduced the India-Middle East-Europe Corridor (IMEC). This ambitious project aims to foster economic development by enhancing connectivity and integration between Asia, the Arabian Gulf, and Europe. While it carries profound implications for global trade and politics, the IMEC also represents a dynamic shift in regional alliances and aspirations.

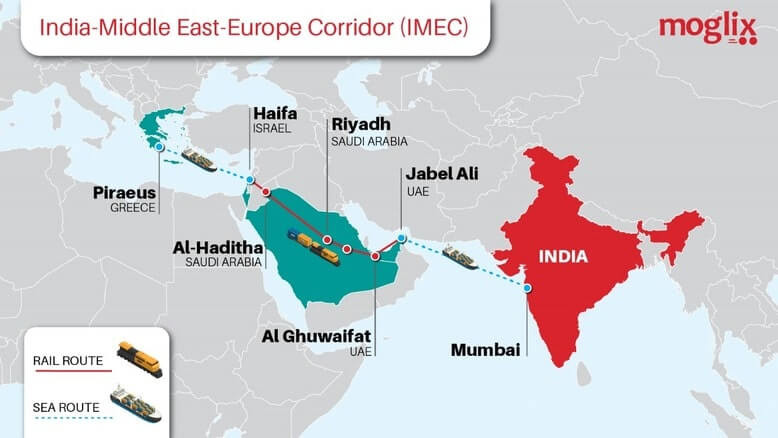

The IMEC at a Glance

The India-Middle East-Europe Corridor is a multimode transit corridor spanning over 3,000 miles, consisting of two primary corridors. The eastern corridor connects India to the Arabian Gulf, while the northern corridor links the Arabian Gulf to Europe. This extensive project, as outlined in the White House’s memorandum of understanding, will establish a reliable and cost-effective cross-border ship-to-rail transit network. It is designed to complement existing maritime and road transport routes, facilitating the seamless movement of goods and services between India, the UAE, Saudi Arabia, Jordan, Israel, and Europe. It is not limited to rail and shipping routes; rather, it includes an electricity cable, a hydrogen pipeline, and a high-speed data cable. This diverse range of infrastructure projects is poised to enhance trade and energy flows among the participating countries.

A Counter to China’s Belt and Road Initiative

China’s Belt and Road Initiative (BRI) has been a prominent player in global infrastructure development over the past decade. However, recent data suggests a stagnation in the value of new foreign contracted projects under the BRI since its peak in 2019, coinciding with China’s domestic real estate debt crisis. This economic challenge has raised questions about the sustainability of China’s expansive infrastructure program.

One of the most noteworthy aspects of the IMEC’s unveiling was the swift positioning of the corridor as an alternative to China’s Belt and Road Initiative (BRI). The BRI has significantly expanded China’s influence by developing trade and infrastructure networks across Asia, Europe, and Africa. However, the IMEC is not simply a rival to the BRI; it represents a different approach to regional cooperation.

Saudi Arabia and the UAE, central players in the IMEC, have shown reluctance to engage in a bipolar world order that forces them to choose between China and the United States. Their active participation in both the IMEC and their recent admission to the BRICS group of major emerging economies underscores their commitment to maintaining autonomy and safeguarding their sovereignty.

Deepening Integration and Economic Convergence

The IMEC underscores the deepening integration between India, Saudi Arabia, and the UAE, signifying broader geopolitical and economic convergence between the Middle East and South Asia into West Asia. India has become Saudi Arabia’s second-largest trading partner, with bilateral trade reaching $52.75 billion during 2022-23, elevating Saudi Arabia to India’s fourth-largest trading partner. Similarly, trade between India and the UAE surged to $85 billion in 2022, positioning the UAE as India’s third-largest trading partner for the year 2022-23 and its second-largest export destination.

This shift in regional dynamics also reflects the evolving state of Pakistan-Gulf relations, where Saudi Arabia and the UAE have adjusted their economic and geopolitical posture toward India. This shift acknowledges India’s rising influence and signifies the aspirations of Gulf nations in the emerging multipolar world. In this changing landscape, traditional alliances are being reevaluated to align with geopolitical realities and economic opportunities.

Beyond Energy: Diversification and Autonomy

The IMEC signifies that Gulf states, particularly Saudi Arabia and the UAE, are actively seeking diverse economic and technological partnerships beyond their role as energy producers. While energy remains a core pillar of their economies, the IMEC highlights that they are determined to establish more diversified and resilient economies.

For years, Washington has primarily approached Gulf states with an energy-centric perspective. However, the IMEC signals a shift towards recognizing that bilateral relations with Saudi Arabia and the UAE are multidimensional. Energy is a significant component, but it is not the sole focus. The United States aims to change the trajectory in the Gulf by involving India in both geopolitical and economic aspects.

Way forward

The India-Middle East-Europe Economic Corridor is not merely an infrastructure project; it is a geopolitical game-changer. It signifies the evolving landscape of alliances, the quest for autonomy, and the recognition that the Gulf states are integral players in the global economy. As the project unfolds, it has the potential to reshape the future of connectivity, trade, and geopolitical influence in the Middle East, Asia, and Europe. The IMEC is a declaration that global partnerships can transcend traditional boundaries and create a more interconnected and prosperous world.

Will Data-Drive The UAE’s Path to Global Prominence?

Will Data-Drive The UAE’s Path to Global Prominence?

In the current business landscape, data has become the heartbeat of decision-making, reshaping industries and economies worldwide. To thrive in this era, companies must adopt data-driven strategies that permeate their organizational fabric, from top-level executives to every corner of the hierarchy. The UAE government’s strategic initiatives, underscored by digital transformation and artificial intelligence (AI) integration, have set the stage for a data-driven future. Amidst the changing dynamics spurred by the COVID-19 pandemic, digitalization has become not just an option but a necessity for survival and success.

PioneeringData-Driven Transformation

The COVID-19 pandemic didn’t just shake up the world; it propelled industries into a fast-paced digital transformation. In a telling Dell survey, a whopping 80% of global organizations revealed they ramped up their digital efforts in 2020, all thanks to the pandemic pushing them into gear. No longer a fancy add-on, going digital turned into a must-do for businesses to survive.

But let’s not think of this as just plugging in new tech tools. It’s a big shift in how businesses work. And that’s where the UAE comes in with its bold moves. They’ve taken giant leaps towards turning data into a decision-making superstar. Think about their Digital Government Strategy, their ambitious UAE Centennial 2071 plan, and the smart UAE Strategy for Artificial Intelligence. They’re not just plans; they’re a promise to embrace data like never before. And they’ve got the rulebook sorted with regulatory authorities making sure everything’s on track.

What’s really cool is how they’ve made data part of everyday business life. They’ve thrown open the doors to data, making it work in the background, helping them make smart decisions at every level. This isn’t just about making things look good; it’s about making things work better. They’re using data to make public services sharper, to deal with risks smarter, and to keep ahead in the global competition. The UAE is proving that in this world of new ideas powered by data, following the rules and planning things out isn’t just a plus – it’s what makes digital change really stick.

AI’s Indispensable Connection to Data Sanity

The UAE’s strategic investments in AI are poised to reap substantial rewards, with the country’s AI market projected to hit $1.9 billion by 2026, sporting a CAGR of 36.2%. This growth isn’t confined to the UAE alone; the Middle East’s AI market is on track to surge from $500 million in 2020 to an impressive $8.4 billion by 2026. E-commerce, fintech, and edtech are among the sectors at the forefront of this expansion, buoyed by a solid foundation of infrastructure, robust cybersecurity measures, and a tech-savvy populace.

However, while AI offers immense potential, its effectiveness is inextricably tied to data sanity – the precision, dependability, and pertinence of data. The crux lies in the quality of data that AI algorithms learn from, as these patterns dictate AI’s performance. Real-world instances underscore the perils of compromised data quality, leading to AI mishaps encompassing flawed predictions, subpar decisions, and operational hiccups. It’s a stark reminder that in the realm of AI, data quality is the linchpin upon which success hinges.

The UAE’s commitment to data-driven strategies sets a compelling example for global players. Embracing data-driven transformation isn’t merely a choice; it’s a necessity for survival and triumph. The journey to prominence lies in the hands of those who harness the power of data, ensuring they remain at the forefront of a rapidly evolving business landscape.

India-UAE a Journey Towards De-Dollarization

India-UAE a Journey Towards De-Dollarization

In a world where the U.S. dollar has long reigned as the dominant global currency, the concept of de-dollarization is gaining traction. De-dollarization refers to the process of reducing dependence on the U.S. dollar in international trade, financial transactions, and economic interactions. As economies seek to enhance their financial sovereignty and minimize exposure to external economic fluctuations, two nations stand out as pioneers in this journey: India and the United Arab Emirates (UAE). During Prime Minister Narendra Modi’s recent visit to the UAE, the Reserve Bank of India (RBI) and the Central Bank of the UAE inked two memoranda of understanding (MoUs). These agreements not only herald a new era of trade collaboration but also mark a significant stride toward the de-dollarization of trade relations. Let’s explore how this landmark initiative is set to reshape economic dynamics and pave the way for a more diversified financial landscape.

Local Currencies: A Catalyst for De-Dollarization:

At its core, this initiative introduces a Local Currency Settlement System (LCSS) that’s redefining cross-border transactions. The Local Currency Settlement System (LCSS) simplifies trade by enabling businesses and individuals in both India and the UAE to directly engage in transactions using their own currencies. This approach minimizes external currency dependence and streamlines the trading process.

This shift offers practical advantages. It allows businesses to manage foreign exchange risks more efficiently by avoiding third-party currency conversions. With contracts and invoices in local currencies, businesses can more confidently navigate price fluctuations and engage in fair trade practices.

The move towards local currencies reflects a changing economic landscape, signaling an intention to reshape financial dynamics. While the U.S. dollar remains important, the adoption of local currencies for cross-border transactions is a practical step towards trade autonomy. This shift not only boosts bilateral trade but also encourages investment and economic growth for both countries.

In essence, the LCSS represents a pragmatic approach towards economic autonomy. It’s about facilitating smoother cross-border interactions and nurturing trade relationships using familiar currencies. While the U.S. dollar’s role persists, the LCSS introduces a more diversified and balanced trade framework between India and the UAE

Mitigating ExchangeRate Risks and Fostering Competition

At the heart of this progressive initiative lies a concerted effort to address one of the most pressing hurdles in international trade – the unpredictability of exchange rate fluctuations. Conventionally, trade transactions have been orchestrated using third currencies as benchmarks, inadvertently exposing businesses to the uncertainty of currency valuation. This practice has often complicated pricing strategies and introduced an element of instability into trade dynamics.

By advocating for the adoption of local currencies in export contracts and invoices, this initiative introduces a transformative shift. It is a shift that not only redefines how trade is conducted but also offers a practical solution to the intricate web of exchange rate risks. The move to denominate contracts in local currencies provides a much-needed safeguard against the capricious nature of currency markets. This, in turn, creates an environment that is not only conducive to fostering competitive pricing but also empowers businesses with a newfound level of financial security.

This transition is far more than a mere economic maneuver. It’s a deliberate step towards asserting financial sovereignty – a demonstration of a nation’s ability to insulate its trade from external fluctuations. It signifies a collective determination to minimize vulnerability to the whims of global currency markets. As industries and businesses increasingly embrace this approach, the broader narrative unfolds as one of self-reliance, resilience, and an unwavering commitment to navigating the intricate complexities of global trade on one’s own terms.

Elevating Economic Ties

The partnership between India and the UAE has transcended borders and expectations, giving rise to an exceptional trade synergy that surpassed even the most optimistic projections. As we delve into the realms of economic ties, it’s evident that the India-UAE trade collaboration has not merely flourished; it has evolved into a resounding success story. The trade volume between these two nations, standing at an impressive $85 billion in 2022, serves as a testament to the strength and depth of this association.

Beyond the sheer numerical significance, this collaboration bears profound implications for both economies. The metamorphosis of the UAE into India’s second-largest trading partner underscores the pivotal role it plays in the Indian trade narrative. Simultaneously, India’s ascent to becoming the UAE’s third-largest trading partner and second-largest export destination reflects the reciprocal nature of this partnership, where mutual growth and benefits have been seamlessly intertwined.

Delving deeper, the robust foundation of this economic alliance is fortified by India’s influential position as the UAE’s fourth-largest investor. This underscores a shared vision of cultivating economic diversity and resilience. As India invests in the UAE, it not only signifies a financial commitment but also echoes a vote of confidence in the UAE’s potential as a strategic economic partner.

The confluence of trade, investment, and collaboration serves as a beacon illuminating a path towards a multifaceted economic ecosystem. The transformation of trade figures into tangible opportunities for businesses, entrepreneurs, and industries resonates with the core essence of this partnership. It’s a synergy that transcends numbers, encapsulating the shared aspirations of both nations to propel their economies to new horizons.

In essence, the India-UAE economic alliance is not merely about transactions; it embodies the essence of cooperation, growth, and progress. It stands as a living testament to the belief that partnerships built on trust, shared values, and complementary strengths can transcend expectations, elevate bilateral relations, and reshape the future economic landscape.

Seamless Transactions and Reduced Reliance on the Dollar

The second Memorandum of Understanding (MoU) stands as a testament to this endeavor, marking a pivotal stride in the de-dollarization effort. By ingeniously linking India’s Unified Payments Interface (UPI) with the UAE’s Instant Payment Platform (IPP), this initiative unfolds a realm of possibilities. It’s a strategic move that defies the traditional norms of global financial transactions and charts a new course driven by innovation and collaboration.

A cornerstone of this integration is the coupling of card switches—RuPay switch and UAESWITCH—a convergence that shatters barriers and paves the way for cross-border fund transfers of unparalleled efficiency. This union of payment systems heralds a new era of fast, secure, and cost-effective transactions, a realm where geographic boundaries hold no sway over the movement of funds. As two powerful systems unite, they create an intricate yet seamless web of financial connectivity, enabling individuals and businesses to navigate the intricate world of cross-border payments with unparalleled ease.

While this innovation bears far-reaching significance, its impact is particularly pronounced for the 3.5 million resident Indians in the UAE. Remittance costs, which have long weighed heavily on the minds of expatriates, are now poised to undergo a transformation. The alliance of UPI and IPP presents a viable solution, addressing a pressing concern by ushering in an era of reduced transaction costs. This move is more than a mere convenience; it’s a tangible relief for the millions who diligently contribute to their home country’s economy while supporting their families from afar.

In essence, the integration of UPI and IPP is more than a technical accomplishment; it’s a testament to the commitment of both nations to facilitate smoother financial interactions and bridge the gap between geographic distances and financial complexities. As these systems converge and resonate, they paint a portrait of a future where economic interactions are not bound by the constraints of the past but propelled by the possibilities of innovation. It’s a journey that encapsulates the essence of partnership, as two nations come together to rewrite the script of international financial transactions and set new standards of efficiency, inclusivity, and progress.

As India and the UAE embark on this transformative journey of trade diversification and reduced dollar reliance, they illuminate the path for others to follow. The de-dollarization momentum they’ve set in motion resonates far beyond their borders. This initiative signifies more than just financial innovation; it’s a declaration of economic resilience, strategic collaboration, and the pursuit of a future where financial sovereignty takes center stage. Through the India-UAE MOU, the stage is set for an epochal shift in trade dynamics, echoing a call for more balanced and diversified financial interactions on the global stage.

Transforming UAE’s Supply Chains for Sustainability and Transparency!

Transforming UAE’s Supply Chains for Sustainability and Transparency!

The UAE, like many other geographies, faces challenges in ensuring traceability and accountability in supply chains. Complex global networks, limited visibility, and reliance on manual processes hinder accurate data capture and verification. Recently though, the focus on sustainable practices and transparency in supply chains has gained significant momentum. Consumers and businesses in the UAE are increasingly conscious and concerned of the origin and environmental impact of products. To address these concerns and foster a greener economy, the UAE is increasingly focusing on blockchain as a technology to revolutionize traceability and accountability in its supply chains. Blockchain has the potential to play a pivotal role in driving sustainability and enhancing trust in the UAE’s supply chain ecosystem.

The energy sector stands is a prime example of an industry where blockchain can exert significant influence. With the potential for energy plants to cause irreparable harm, this highly regulated sector operates under intricate global and regional procedures, all while striving for sustainability. Global blockchain in energy market is projected to reach $1,564M by 2026 with a CAGR of 37.6%, as per Fortune Business Insights. The growing adoption of blockchain technology in the energy sector addresses regulatory compliance, sustainability, and process efficiency. This market growth signifies the transformative potential of blockchain in revolutionizing the energy industry for a sustainable future. By integrating blockchain technology, the energy sector effectively addresses these challenges, accelerating industry processes while ensuring compliance and environmental responsibility.

These changes are not just visible and confined to an industry. The UAE has witnessed remarkable implementations of blockchain-enabled traceability. For example, the Dubai Blockchain Food Safety Project leverages blockchain to enhance food safety by ensuring end-to-end traceability of food products. Similarly, the Emirates Authority for Standardization and Metrology (ESMA) collaborates with blockchain companies to authenticate halal products, fostering transparency and meeting Islamic dietary requirements.

Benefits of Blockchain-Enabled Traceability

The application of blockchain in supply chain management offers numerous advantages, including increased transparency, improved efficiency, enhanced traceability, and strengthened customer relationships. It also contributes to a better brand image and higher return on investment for businesses.

- Real-time tracking: Blockchain enables transparency and decentralization, allowing real-time tracking of activities in the supply chain, leading to increased transparency in industries like manufacturing and fashion.

- Faster processing: By replacing intermediaries and eliminating paper-based processes with smart contracts, blockchain reduces operational time and improves efficiency, especially in lower supply tiers and the shipping industry.

- Strengthening traceability: Blockchain technology enhances traceability in the supply chain, addressing demands and regulations for provenance information. It mitigates quality-related issues, such as reputational damage, recalls, and revenue loss due to counterfeit or unauthorized products.

- Healthy customer relationships: Blockchain empowers consumers to access detailed product information and track orders transparently, fostering trust and improving customer experience.

- Higher ROI: Blockchain helps businesses build a strong brand image in the decentralized market, leading to increased return on investment.

- Effective tradeability: Blockchain facilitates efficient licensing and ownership by utilizing smart contracts and maintaining consensus, ensuring accurate tracking of ownership records.

Overcoming Challenges and Adoption Considerations

While blockchain offers immense potential, challenges such as scalability and interoperability need to be addressed for widespread adoption in the UAE. Collaborative efforts among industry stakeholders, government support, and the development of regulatory frameworks are pivotal in overcoming these obstacles. The UAE Government issued Cabinet Resolution No.111 of 2022, which became effective on January 14, 2023. This resolution aims to regulate virtual asset-related activities by providing guidelines for entities engaged in such activities. The purpose is to ensure that these entities obtain the necessary licensing and approvals from Financial Regulators or their delegates. The UAE government has been pushing the envelope on blockchain and digital assests from last decade. The Emirates Blockchain Strategy was introduced by the UAE government in April 2018. Its objective is to leverage blockchain technology in order to migrate 50% of government transactions onto the blockchain platform by 2021. The strategy encompasses various initiatives that target improved efficiency, cost reduction, and enhanced customer experience.

Future Outlook

The future of sustainable supply chains in the UAE is intertwined with blockchain technology. As the UAE continues to prioritize environmental sustainability, blockchain’s integration with emerging technologies like the Internet of Things (IoT) and artificial intelligence (AI) will further enhance supply chain transparency and efficiency. For technologies to cross hands data will have to play a crucial role since AI relies heavily on data, hence data sanity will be of utmost importance. Moglix has been working with organisations in the UAE to sort their data challenges and transform their procurement value chain at a rapid yet sustainable pace

Embracing blockchain enables the UAE to solidify its position as a global leader in sustainable practices and reinforces its commitment to a greener future. The UAE’s commitment to revolutionizing supply chain traceability and accountability through blockchain technology demonstrates its dedication to sustainability and transparency. By leveraging blockchain, the UAE is building a robust and trustworthy supply chain ecosystem that aligns with consumer expectations, protects the environment, and drives the nation’s sustainable development goals.